In the previous posts we had looked at a delta hedged short call position, which we argued was a way of expressing a view on ‘large’ movements in spot and changes in implied volatility. Here are some more thoughts on the strategy.

The position was “gamma negative”, in that an increase in the spot price caused delta to fall from -0.56 to -0.68 i.e. an inverse relationship. Had the position been created using a short put (which would have a positive delta) an increase in spot will also have seen a fall in delta as the option moves OTM and so would also be gamma negative.

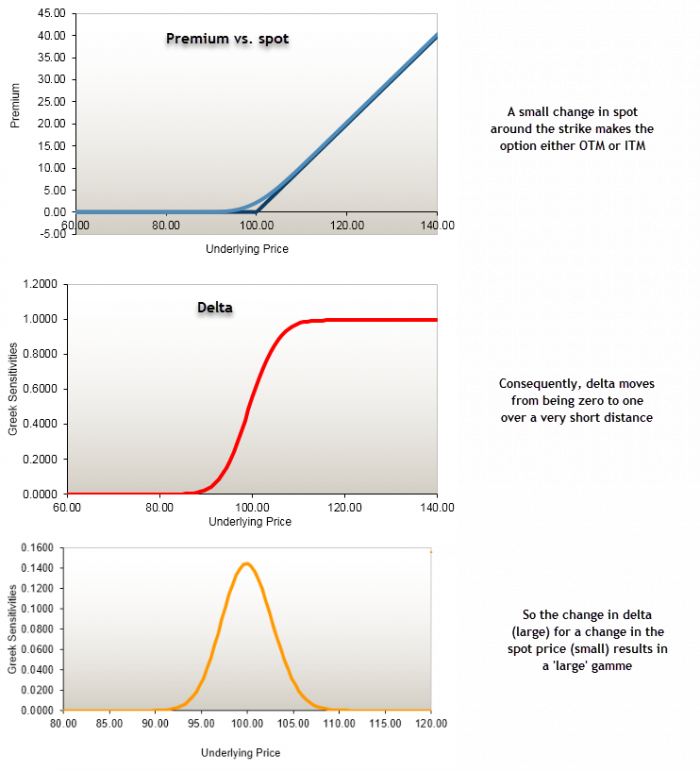

We can also think about ‘large’ and ‘small’ gamma values. If the option is OTM or ITM the slope of the delta line with respect to price is shallow and so gamma is small. The delta – spot relationship for a short-dated ATM option is relatively steep and so gamma is relatively high. The following diagram illustrates.

If I buy options (either calls or puts), I will always be gamma positive. Selling options will make me gamma negative. Neither strategy is inherently ‘bad’ as it depends on the view the trader is looking to express and what happens to market prices.

In our example, the short call position would lose money if the spot market moved significantly. So why would I do such a strategy? Don’t forget the third element of option trading – the passage of time. Our calculations had been done on an intraday basis to remove the impact of time. If we were to analyse the position the following day, we would see that the option would have fallen in value (all other things being equal). This reduces the close out cost to the seller resulting in a profit. This highlights the nature of the strategy – the trader must believe that the passage of time will have a greater impact on the profit than any loss incurred through their delta hedging activities.

We could also flip the position over and say that a delta-hedged long call position would make money if the spot price were volatile. Here the trader’s challenge is to ensure that the profit and loss on their delta hedging activities would outweigh any loss incurred from the passage of time.