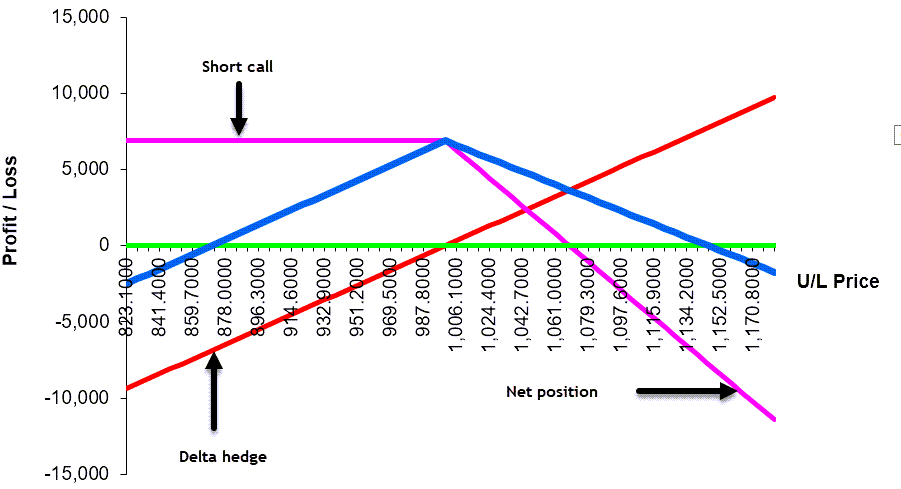

In the previous post we looked at the payoff that combined a short call position with a delta hedge such that the trader was immune from small changes in the underlying price. This is shown in the attached diagram with the blue line showing the “at expiry” profit or loss.

This strategy left the trader with some residual exposures, which are worth investigating. At first glance the net payoff of such a strategy does resemble a short volatility trade a.k.a. a straddle. But what type of volatility are we describing?

I recall one trader saying to me that “expecting spot to be volatile is not the same as expecting an increase in implied volatility“. Let’s explore this crucial statement using the attached diagram.

If the spot price is volatile in either direction, then the net payoff shows that the trader will lose money. Equally a stable spot price will result in a profit. But we would describe this type of volatility as ‘realised’ volatility – it is what did happen (past tense). But suppose that shortly after putting on the trade the option’s implied volatility decreased. That is the range of values that the spot price was expected to experience was likely to narrow. Notice this is a forward-looking statement and says nothing about what is happening to the current spot price. Indeed the impact will be that the current p/l profile shown in green, would increase resulting in a profit. The option premium will have fallen meaning that the cost to close out the position will have reduced, resulting in a profit the trader.

There is sometimes an incorrect assumption made about spot price movements and volatility. Some people seem to think they are one and the same thing and this is not the case as in an option pricing framework they are independent variables. It may well be that spot becoming more volatile may signal a fundamental move in the underlying price resulting in a change in implied vol but this is not an automatic process.