The FX basis

The question we seek to address in this blog is which interest rates should you use to calculate the forward rate? Different banks will use different rates which will reflect their credit ratings and with the demise of LIBOR it is likely that banks will use some form of Overnight Average rate such as SONIA (in the UK), SOFR (in the US) and ESTER for EUR. This takes us in the mysterious world of the FX basis.

Defining terms

What is the FX basis? In their text “Fixed Income Relative Value” Huggins and Schaller state: “The FX basis reflects the sum of global capital market flows chasing the currency which offers superior funding and investment opportunities.”

Suppose a EUR corporation has executed a EURUSD FX swap whereby it has ‘lent’ EUR in return for ‘borrowing’ USD. In the FX market this translates into a spot sale of EUR for a purchase of USD . The forward leg of the swap requires the corporate to buy EUR and sell USD.

A previous post looked at how we could use the ratio of the two interest rates in either currency to determine the forward rate. But after the 2008 financial crisis a dislocation emerged between the forward FX rate implied by two observed interest rates and the forward rate traded in the market.

An example

Let us assume the 1 year EURUSD FX basis is -21.00. What does this mean? If we take both the observed spot FX rate and an observed USD interest rate, we can back out the implied EUR interest rate that generates a value equal to the observed forward rate. If the basis is -21 it means that we need to subtract 21 basis points (0.21%) from the observed EUR rate in order to calibrate our calculation to match the observed forward X rate. Notice that by convention the basis is applied to the non-USD currency.

One way to think about the concept is in supply / demand terms. Going back to our EURUSD FX swaps the corporation will pay USD SOFR on the dollars it is borrowing but will earn EUR ESTER minus 21 basis points on the euro leg of the transaction. This tells us that USD is in greater demand than EUR and anyone who does own USD can lend the currency and benefit from a lower EUR borrowing cost.

The FX basis over time

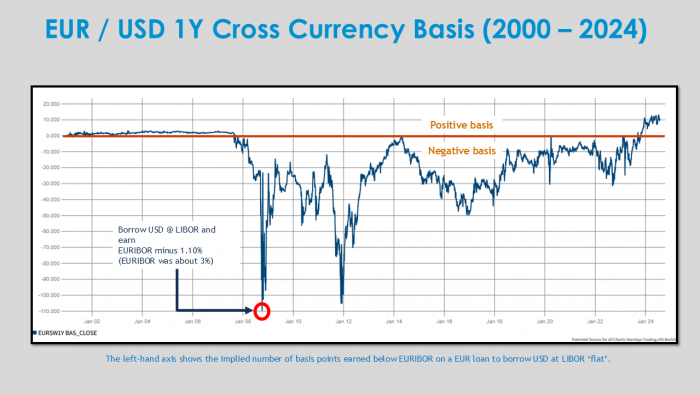

The following diagram shows how the EURUSD FX basis has evolved ove the last quarter century. From 200 to 2008, the basis was close to zero implying that the observed forward FX rate derived its value from observed money market values for EUR and USD. Note that after the collapse of Lehman in 2008 USD was in high demand and so the basis was very negative. This meant that borrowing USD would cost LIBOR but the interest earned on the EUR collateral would be EURIBOR minus 1.10%. Looking at the far right hand side of the diagram we can see that in 2024 the basis turned positive suggesting that EUR was in greater demand than USD.

Source: Barclays, author