Recap

In part 1, we focused on the features of credit indices, on which the options are most commonly based. This second post covers the terminology associated with credit options.

Terminology

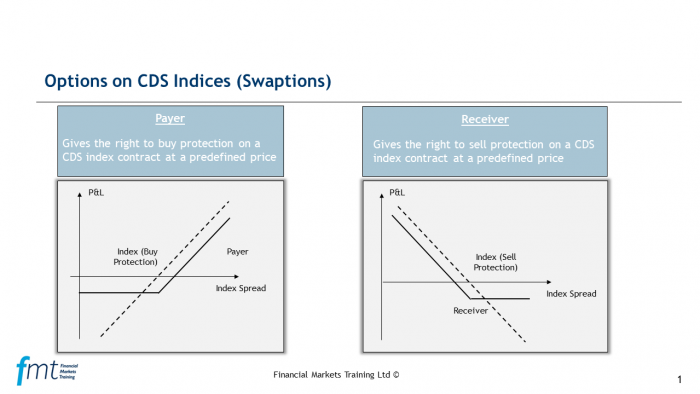

Credit options have adopted terminology associated with the fixed income market, so it is common to talk about ‘payers’ and ‘receivers’. The options are short-term in nature (1 or 3 months are common), European in style and typically reference the 5 year on-the-run index. The following image illustrates the two different positions. Note that the payer is a call on credit spreads, while the receiver is a put.

A long payer option gives the holder the right to buy protection on a CDS index contract at a pre-defined par spread price. A long receiver option gives the holder the right to sell protection on a CDS index contract at a predefined par spread.

In-, out- or at-the-money

The confusing aspect is that the strike represents the par spread of the CDS compared to the standard fixed coupon. I may buy a payer option with an ATM strike of 120 bps, meaning if exercised, I would pay a quarterly premium of 100 bps annually in an index CDS. But since the strike of the option is 120 basis points, I would need to pay an upfront adjustment as I am paying a coupon that is below the current on-market rate. This upfront adjustment is not a feature that is specific to the option – this applies to both single name and index CDS with no optionality.

Upfront adjustment

Calculating the upfront adjustment involves finding the present value of the difference between the par spread and the coupon. If the notional was 10m, the buyer would be ‘underpaying’ by 20 basis points per year, totalling 20,000 over a 5-year CDS index (120bps -100bps *10m).. This calculation requires present valuing, and an additional step, not covered in this context, involves further adjusting the cash flow by applying a survival probability.

From the options perspective, if the par spread at expiry is (say) 130 bps the purchase of CDS index with no optionality associated would have an undiscounted upfront adjustment of 30,000. So ignoring premiums for the moment, it makes sense to exercise the option.

It is important to note that this upfront adjustment is not the option premium – that is a separate element which we will cover in a subsequent post.